Most investors don’t fail because they’re wrong about the markets. They fail because they’re wrong about themselves.

We chase new strategies, react to headlines, and confuse movement with progress. But history is clear, intelligence alone doesn’t create wealth. You don’t need to be smarter than the market, you just need to stop fighting yourself.

As Benjamin Graham once warned:

"The investor’s chief problem — and even his worst enemy — is likely to be himself."

Yet, calm isn’t easy. It takes structure, reflection, and the right tools.

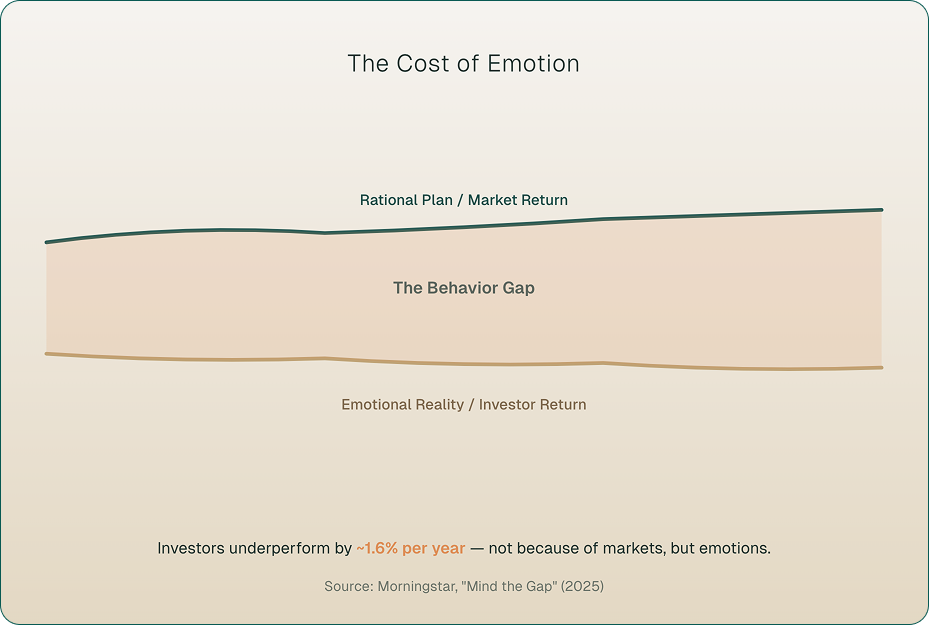

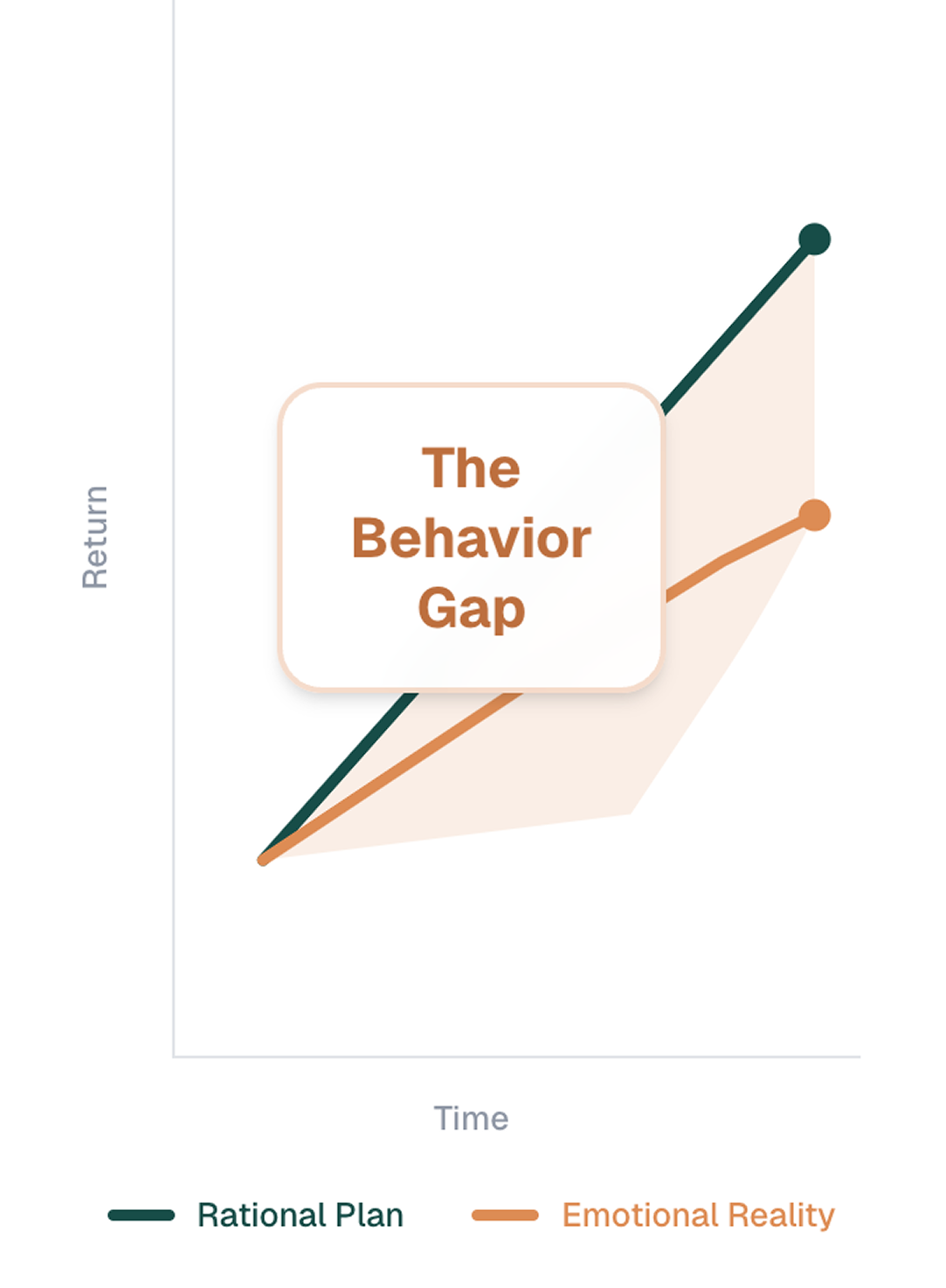

For decades, data has shown a painful truth — investors consistently underperform the very funds they invest in.

In Morningstar’s 2025 Mind the Gap , the average investor lagged their own investments by 1.6% per year not because the funds performed poorly, but because investors bought high and sold low.

Dalbar’s 30-year analysis revealed an even larger gap: over 3% annually lost to impulsive decisions and emotional timing.

That’s not a small number. Over 30 years, that behavior gap compounds into hundreds of thousands in lost wealth.

The lesson is clear: the biggest cost in investing isn’t fees — it’s emotion.

Fear, overconfidence, and short-term noise turn rational plans into reactive decisions.

And no algorithm can fix that. Only awareness can.

Even a 3–6% behavior gap can compound into $100,000+ lost over a typical investing lifetime.

Most of us were taught that investing success means finding the “right” fund, the “right” manager, or the “right” moment.

The evidence says otherwise.

Actively managed mutual funds underperform their passive benchmarks 90% of the time over 15 years. High-fee advisory models quietly drain long-term returns.

Even sophisticated investors, with access to research, models, and tools, fall prey to the same emotional traps.

As Warren Buffett wrote in his 1996 shareholder letter

“Investing is simple, but not easy.”

Yet, even with this knowledge, most people still struggle to follow their plan. That’s not a financial problem. It’s a behavioral one.

You don’t need to outsmart the market, you need to stop fighting yourself.

The best investors share three traits:

Calm investors don’t chase trends.

They stay aligned with their values, tolerate volatility, and measure progress over decades, not days.

That’s why we built Myndvest:

To give every investor the structure, reflection, and tools to act less impulsively and more intentionally.

You don’t need a Wall Street address or a high-fee advisor to build wealth. You need a framework that teaches you to think clearly, act rationally, and reflect consistently.

Independent investors who manage their behavior, not just their portfolios, gain:

At Myndvest, we’re building the behavioral muscle that makes that independence sustainable.

Our philosophy rests on three pillars — grounded in behavioral science:

Together, these form the Reflection Loop:

Observe → Reflect → Realign → Repeat.

Over time, the Reflection Loop turns awareness into instinct, helping investors close the behavior gap and stay calm when it counts most.

The biggest threat to returns isn’t volatility. It’s anxiety.

At Myndvest, we call it The Calm Premium — the hidden advantage of disciplined investors.

Those who stay rational through noise capture the compounding others forfeit.

Studies by Vanguard and BlackRock confirm it:

"Investors who maintain consistent exposure outperform reactive peers by 2% annually, not through strategy, but through patience."

Calm, it turns out, compounds.

I started Myndvest with one belief:

Wealth isn’t built by predicting markets, but by managing emotion.

For years, I watched smart people, myself included, make the same mistakes: chasing trends, reacting to headlines, mistaking volatility for risk.

The more I studied the best investors, from Buffett’s patient rationality to the quiet conviction of passive investing pioneers, the clearer it became: calm is a strategy.

So we built Myndvest to help investors practice investment success.

Thanks for reading, and for giving Myndvest a try.

You can always contact me directly if you have any questions at hello@myndvest.com.

I look forward to hearing from you.